CashWise: Product that simplifies Personal Finance

Powered By EmbedPress

This project, CashWise, is a comprehensive personal finance product aimed at simplifying financial management for working professionals aged 22-40. It consolidates scattered financial data into a unified platform, offering insights, budgeting, investment tracking, and personalized analytics to help users make informed decisions and achieve financial goals.

Project Summary

Goal: Build a user-friendly, educational personal finance app that centralizes users’ financial data across banks, investments, loans, and expenses to streamline management and empower better decision-making.

Problem: Users face challenges managing expenses, savings, and investments spread across multiple platforms, lack robust tools for progress tracking toward financial goals, and worry about data security.

Target Users: Urban working professionals with average monthly incomes around 50,000 INR, tech-savvy but lacking clear financial planning and overwhelmed by scattered financial information.

Key Features & Solutions

Finance Fusion View: Centralizes linked bank accounts, investments, loan balances, and liabilities for a holistic net worth snapshot.

Monthly Expense & Budget Tracking: Detailed category-wise transaction tracking, monthly budget setting, and real-time spend alerts to prevent overspending.

FuturePot & FunSaver: Savings pots for future goals with interest earnings, encouraging habitual saving.

Spend Analytics & Alerts: Visual breakdowns of spends, personalized notifications for unusual expenditures, and actionable analytics.

Loan Tracker: Comprehensive debt management allowing users to monitor and explore financing options.

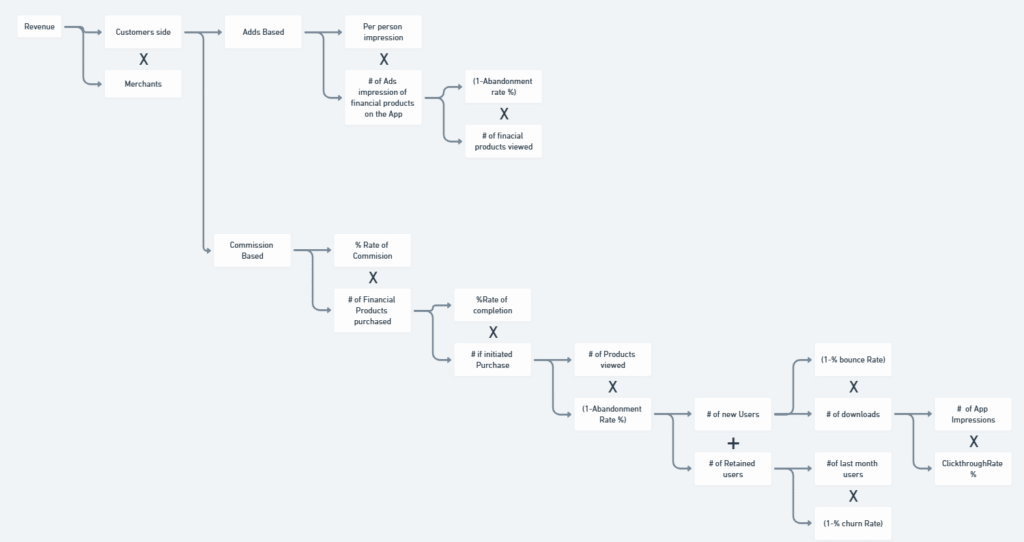

Referral and Monetization: Revenue through commission-based finance product advertisements, cost-per-click ads, and user rewards programs.

Achievements

Conducted extensive user research, identifying key pain points related to scattered financial data, lack of budgeting tools, and data security concerns.

Developed a robust MVP design and system architecture leveraging load balancers, app servers, caching, and Kafka message broker for real-time financial data processing.

Delivered measurable business metrics such as monthly active users, feature adoption rate, churn rate, and net promoter score (NPS) to track user engagement and satisfaction.

Established clear revenue generation streams through integrated advertisements and commission fees aligned with user engagement and transactions.

Implemented comprehensive security measures and regular audits to mitigate risks related to data privacy and cybersecurity.

Tools and Technologies Used

Cloud-based infrastructure with load balancing and caching to handle high user loads.

Kafka for real-time event processing and integration of financial data.

Multiple database tables for managing user profiles, transactions, investments, budgets, and alerts.

Mobile and web platforms for seamless access to financial dashboards, spend tracking, and budget management.

Summary

CashWise is a user-centric, data-driven personal finance platform addressing the complexity and fragmentation in users’ financial lives. The project showcases strong product management capabilities through thorough market research, problem validation, feature prioritization, system design, and execution backed by measurable metrics and scalable technology, all aimed at improving financial literacy and management for a key urban demographic.

Indepth Reseach

Over view of Market research:

The market research overview for personal finance apps highlights several key points shaping this rapidly growing industry:

The global personal finance app market was valued around USD 17.75 billion in 2024 and is projected to reach over USD 21.4 billion in 2025, with a compound annual growth rate (CAGR) of over 20% expected through the next decade. This growth is driven largely by increasing smartphone adoption, internet accessibility, and the demand for digital-first financial management solutions, especially among younger generations like millennials and Gen Z.

Financial literacy efforts and the need to manage uncertain economic conditions are fueling demand for budgeting, expense tracking, and personalized financial advice features within these apps. AI-powered insights and robo-advisory services are becoming mainstream, providing users with tailored recommendations for saving and investing based on their individual financial profile.

Data security and privacy concerns remain significant barriers to adoption. Users are cautious about sharing sensitive financial data, prompting developers to implement stringent security protocols and transparency to build trust and comply with regulations like GDPR and CCPA.

Market segmentation demonstrates dominance of Android platforms globally, with iOS also holding sizeable market share due to its reputation for robust security features. Personal finance apps cater to diverse user needs ranging from expense tracking to investment management, payments, and wealth management across various geographies including North America, Europe, Asia-Pacific, and emerging markets.

Emerging trends such as integration of sustainability features to track environmental impact through financial decisions, voice and natural language interfaces for hands-free operation, and focus on mental health aspects of financial stress reflect the evolving scope of personal finance apps beyond traditional budgeting.

Overall, the market research underscores a strong growth trajectory in personal finance apps driven by technological advancements, increasing consumer demand for personalized and accessible financial management, and challenges in securing user data that shape product development and marketing strategies

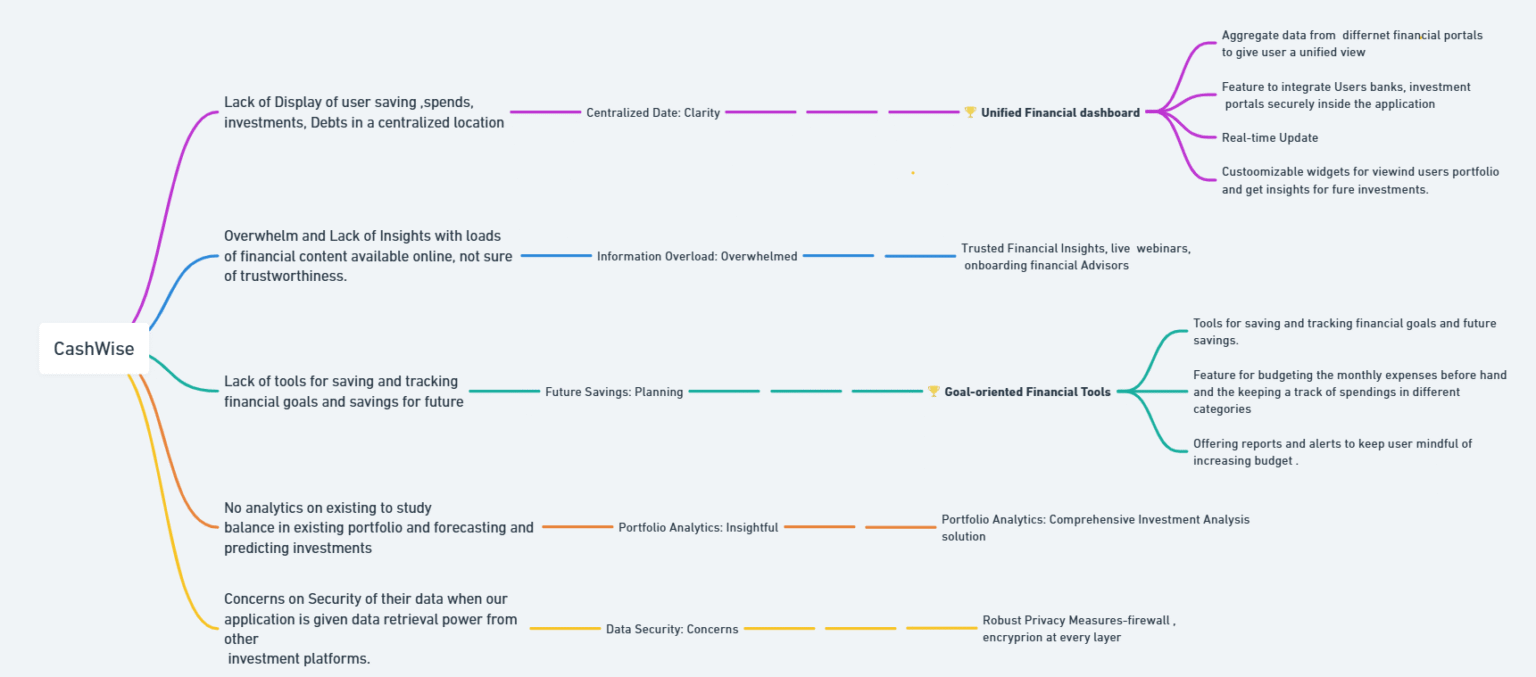

Mind Map

Mapping Business outcome to product outcome